[SMM Hot Topic] Analysis of Steel Billet and Hot-rolled Steel Export from January to July

- Steel Billet

According to data from the General Administration of Customs, the total domestic steel billet export volume from January to July 2025 reached 7.472 million mt, up 309.72% YoY. In July, the total domestic steel billet export volume was 1.5798 million mt, up 34.37% MoM and 349.07% YoY. Among them, square billets accounted for 53.96%, and plate billets accounted for 14.63%.

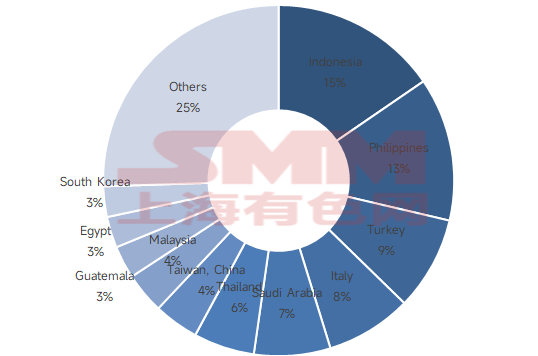

Based on data compiled by SMM from the General Administration of Customs, in terms of export destinations, Indonesia ranked first in the cumulative total steel billet export volume from January to July 2025, with a total of 1.154 million mt, accounting for 15% of the total steel billet export volume. The Philippines followed with an export volume of 988,600 mt, accounting for 13% of the total. Turkey ranked third with 646,400 mt, accounting for 9% of the total.

- Hot-rolled Steel

The latest data from the General Administration of Customs shows that in July 2025, China exported 6.13 million mt of steel sheets & plates, up 19.0% YoY. The cumulative export volume from January to July reached 42.45 million mt, up 2.3% YoY. In July, China exported 1.59 million mt of steel bars, up 77.2% YoY. The cumulative export volume from January to July was 10.62 million mt, up 52.4% YoY.

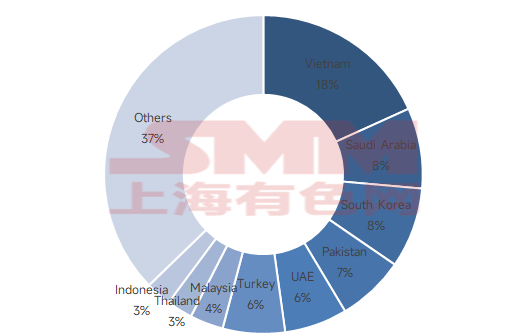

Based on data compiled by SMM from the General Administration of Customs, in terms of hot-rolled steel, the total export volume from January to July 2025 reached 14.6379 million mt. In terms of export destinations, Vietnam still ranked first in the cumulative total hot-rolled steel export volume from January to July 2025, with a cumulative volume of 2.6683 million mt, accounting for 18% of the total hot-rolled steel export volume. Saudi Arabia followed with an export volume of 1.1976 million mt, accounting for 8% of the total. South Korea ranked third with 1.1943 million mt, also accounting for 8% of the total.

However, compared with the data from the same period last year, the cumulative total export volume of hot-rolled steel from January to July 2025 decreased significantly, which is closely related to the frequent anti-dumping cases faced by hot-rolled steel products this year. The significant increase in the year-on-year growth rate of steel billet exports also reflects its more flexible export and fewer restrictions. And Saudi Arabia's prominent position in this ranking also indicates that the Middle East market remains the primary growth market for trade this year. For more details, please refer to the SMM Steel Export Weekly. To obtain more information, please scan the QR code below.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)